How to Stay Protected From the European Banking Crisis

Contents:

This means that even if a bank collapsed, customers could reclaim deposits from this Government-backed safety net scheme. It depends on whether this is held with different banks. But in some acquisitions banks retain their separate banking licences. What if a bank collapse triggers a wave of other failures? In theory yes, provided these were from separate banks. In the last banking crisis some people would have held money with both IceSave and Kaupthing Singer two Icelandic banks that collapsed and would have been able to claim for both from the FSCS. This can be complex, particularly due to the number of mergers and acquisition in recent years.

The FSCS has more details on its website www. A number of overseas banks now offer market-leading savings accounts to UK consumers. All European protection scheme now offer the same level of compensation euros , but customers may be less confident about speedy redress if they are dealing with an overseas quango, application forms in a foreign language and of course, a country that may itself have serious debt problems.

You can find out whether any firm or individual is authorised by the FSA by telephoning or going to www. This was the term coined when banking systems last froze, as the costs of bank lending rose on the back of bad debt fears. In extreme cases this lack of liquidity could spark another wave of bank failure. Access to credit is likely to become more restricted, and more expensive. In this scenario banks will only lend to their most credit worthy customers. Check you credit file and pay down any debts you can to make yourself less risky prospect.

The European debt crisis is a multi-year debt crisis that has been taking place in the European . However, in the early s, some EU member states were failing to stay within the confines of the can ensure that downstream nations and banking systems are protected by guaranteeing some or all of their obligations. A timeline of the debt crisis of the eurozone, from the creation of the currency in Spain passes a constititional amendment to add in a "golden rule," keeping Banks must also raise more capital to protect them against losses resulting.

If you know you need to remortgage, or borrow money within the next six months you may want to consider applying now, if you are worried about the situation deteriorating significantly. In the last credit crunch banks required far higher deposit and mortgage rates went up, particularly for fixed-rate deals. Those due to remortgage may want to consider doing so now, while rates are still fairly competitive and before any further house price falls erode the equity in your home. That said, for those who are on a cheaper standard variable rate SVR deal, or would move to one at the end of any introductory offer it may pay to simply stay put.

With fears of a double-dip recession it is unlikely that central banks will push up interest rates any time soon. However, competitive fixed rates are at present, they are still significantly higher than the 2. Find out how to invest in recovery with this free guide. Help protect yourself from Identity Fraud with CreditExpert. This is the refrain from Washington, Beijing, London, and indeed most of the capitals of the euro zone. Why hasn't the continent's canniest politician sprung into action?

The crisis is pressuring the Euro to move beyond a regulatory state and towards a more federal EU with fiscal powers. Control, including requirements that taxes be raised or budgets cut, would be exercised only when fiscal imbalances developed. On 6 June , the European Commission adopted a legislative proposal for a harmonised bank recovery and resolution mechanism. The proposed framework sets out the necessary steps and powers to ensure that bank failures across the EU are managed in a way that avoids financial instability.

The proposal is part of a new scheme in which banks will be compelled to "bail-in" their creditors whenever they fail, the basic aim being to prevent taxpayer-funded bailouts in the future. Each institution would also be obliged to set aside at least one per cent of the deposits covered by their national guarantees for a special fund to finance the resolution of banking crisis starting in A growing number of investors and economists say Eurobonds would be the best way of solving a debt crisis, [] though their introduction matched by tight financial and budgetary co-ordination may well require changes in EU treaties.

Using the term "stability bonds", Jose Manuel Barroso insisted that any such plan would have to be matched by tight fiscal surveillance and economic policy coordination as an essential counterpart so as to avoid moral hazard and ensure sustainable public finances. Germany remains largely opposed at least in the short term to a collective takeover of the debt of states that have run excessive budget deficits and borrowed excessively over the past years.

ESBies could be issued by public or private-sector entities and would "weaken the diabolic loop and its diffusion across countries". It requires "no significant change in treaties or legislation. In the idea was picked up by the European Central Bank. The European Commission has also shown interest and plans to include ESBies in a future white paper dealing with the aftermath of the financial crisis. On 20 October , the Austrian Institute of Economic Research published an article that suggests transforming the EFSF into a European Monetary Fund EMF , which could provide governments with fixed interest rate Eurobonds at a rate slightly below medium-term economic growth in nominal terms.

These bonds would not be tradable but could be held by investors with the EMF and liquidated at any time. To ensure fiscal discipline despite lack of market pressure, the EMF would operate according to strict rules, providing funds only to countries that meet fiscal and macroeconomic criteria. Governments lacking sound financial policies would be forced to rely on traditional national governmental bonds with less favourable market rates.

The econometric analysis suggests that "If the short-term and long- term interest rates in the euro area were stabilised at 1. At the same time, sovereign debt levels would be significantly lower with, e. Furthermore, banks would no longer be able to benefit unduly from intermediary profits by borrowing from the ECB at low rates and investing in government bonds at high rates.

The Boston Consulting Group BCG adds that if the overall debt load continues to grow faster than the economy, then large-scale debt restructuring becomes inevitable. The authors admit that such programmes would be "drastic", "unpopular" and "require broad political coordination and leadership" but they maintain that the longer politicians and central bankers wait, the more necessary such a step will be. Thomas Piketty , French economist and author of the bestselling book Capital in the Twenty-First Century regards taxes on capital as a more favorable option than austerity inefficient and unjust and inflation only affects cash but neither real estates nor business capital.

According to his analysis, a flat tax of 15 percent on private wealth would provide the state with nearly a year's worth national income, which would allow for immediate reimbursement of the entire public debt. Instead of a one-time write-off, German economist Harald Spehl has called for a year debt-reduction plan, similar to the one Germany used after World War II to share the burden of reconstruction and development.

According to this agreement, West Germany had to make repayments only when it was running a trade surplus, that is "when it had earned the money to pay up, rather than having to borrow more, or dip into its foreign currency reserves. The European bailouts are largely about shifting exposure from banks and others, who otherwise are lined up for losses on the sovereign debt they have piled up, onto European taxpayers. First, the "no bail-out" clause Article TFEU ensures that the responsibility for repaying public debt remains national and prevents risk premiums caused by unsound fiscal policies from spilling over to partner countries.

The clause thus encourages prudent fiscal policies at the national level.

The European Central Bank 's purchase of distressed country bonds can be viewed as violating the prohibition of monetary financing of budget deficits Article TFEU. Articles and were meant to create disincentives for EU member states to run excessive deficits and state debt, and prevent the moral hazard of over-spending and lending in good times. They were also meant to protect the taxpayers of the other more prudent member states.

By issuing bail-out aid guaranteed by prudent eurozone taxpayers to rule-breaking eurozone countries such as Greece, the EU and eurozone countries also encourage moral hazard in the future. The EU treaties contain so called convergence criteria , specified in the protocols of the Treaties of the European Union. For eurozone members there is the Stability and Growth Pact , which contains the same requirements for budget deficit and debt limitation but with a much stricter regime. In the past, many European countries have substantially exceeded these criteria over a long period of time.

According to a study by economists at St Gallen University credit rating agencies have fuelled rising euro zone indebtedness by issuing more severe downgrades since the sovereign debt crisis unfolded in The authors concluded that rating agencies were not consistent in their judgments, on average rating Portugal, Ireland, and Greece 2. Germany, Finland and Luxembourg.

- The Reality of the Spirit: A Sermon of Meister Eckhart.

- ;

- Timeline: The unfolding eurozone crisis - BBC News;

European policy makers have criticised ratings agencies for acting politically, accusing the Big Three of bias towards European assets and fuelling speculation. France too has shown its anger at its downgrade. Similar comments were made by high-ranking politicians in Germany.

Michael Fuchs , deputy leader of the leading Christian Democrats , said: Why doesn't it act on the highly indebted United States or highly indebted Britain? Credit rating agencies were also accused of bullying politicians by systematically downgrading eurozone countries just before important European Council meetings. As one EU source put it: It is strange that we have so many downgrades in the weeks of summits.

In essence, this forced European banks and more importantly the European Central Bank , e. Due to the failures of the ratings agencies, European regulators obtained new powers to supervise ratings agencies. Germany's foreign minister Guido Westerwelle called for an "independent" European ratings agency, which could avoid the conflicts of interest that he claimed US-based agencies faced. On 30 January , the company said it was already collecting funds from financial institutions and business intelligence agencies to set up an independent non-profit ratings agency by mid, which could provide its first country ratings by the end of the year.

But attempts to regulate credit rating agencies more strictly in the wake of the eurozone crisis have been rather unsuccessful. Some in the Greek, Spanish, and French press and elsewhere spread conspiracy theories that claimed that the U. The Economist rebutted these "Anglo-Saxon conspiracy" claims, writing that although American and British traders overestimated the weakness of southern European public finances and the probability of the breakup of the eurozone breakup, these sentiments were an ordinary market panic, rather than some deliberate plot.

Greek Prime Minister Papandreou is quoted as saying that there was no question of Greece leaving the euro and suggested that the crisis was politically as well as financially motivated. Both the Spanish and Greek Prime Ministers have accused financial speculators and hedge funds of worsening the crisis by short selling euros. Goldman Sachs and other banks faced an inquiry by the Federal Reserve over their derivatives arrangements with Greece.

The Guardian reported that "Goldman was reportedly the most heavily involved of a dozen or so Wall Street banks" that assisted the Greek government in the early s "to structure complex derivatives deals early in the decade and 'borrow' billions of dollars in exchange rate swaps, which did not officially count as debt under eurozone rules. In response to accusations that speculators were worsening the problem, some markets banned naked short selling for a few months. Some economists, mostly from outside Europe and associated with Modern Monetary Theory and other post-Keynesian schools, condemned the design of the euro currency system from the beginning because it ceded national monetary and economic sovereignty but lacked a central fiscal authority.

When faced with economic problems, they maintained, "Without such an institution, EMU would prevent effective action by individual countries and put nothing in its place. Ricci of the IMF, contend that the eurozone does not fulfil the necessary criteria for an optimum currency area , though it is moving in that direction.

As the debt crisis expanded beyond Greece, these economists continued to advocate, albeit more forcefully, the disbandment of the eurozone. If this was not immediately feasible, they recommended that Greece and the other debtor nations unilaterally leave the eurozone, default on their debts, regain their fiscal sovereignty, and re-adopt national currencies. The likely substantial fall in the euro against a newly reconstituted Deutsche Mark would give a "huge boost" to its members' competitiveness.

Iceland, not part of the EU, is regarded as one of Europe's recovery success stories. Labour concessions, a minimal reliance on public debt, and tax reform helped to further a pro-growth policy.

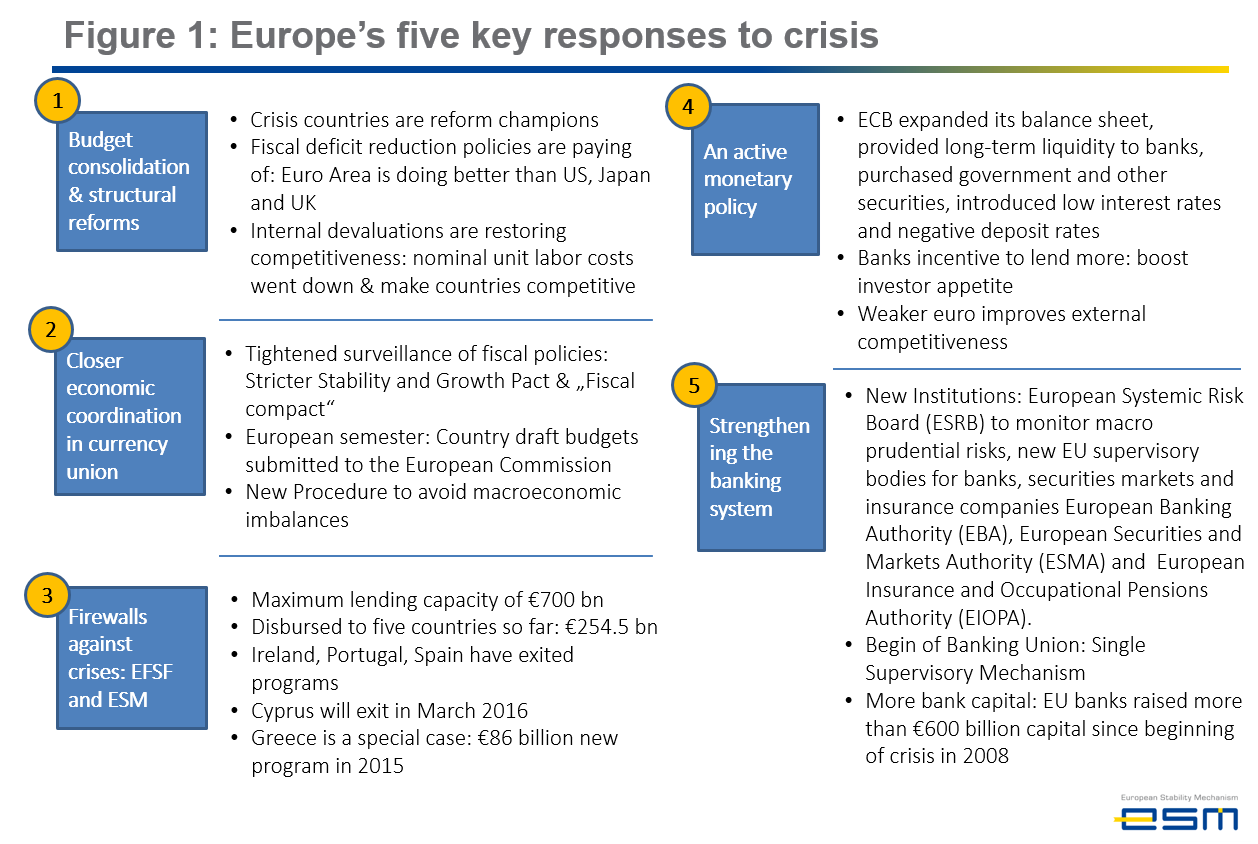

How the financial crisis made Europe stronger

The Wall Street Journal added that without the German-led bloc, a residual euro would have the flexibility to keep interest rates low [] and engage in quantitative easing or fiscal stimulus in support of a job-targeting economic policy [] instead of inflation targeting in the current configuration. There is opposition in this view. The national exits are expected to be an expensive proposition. The breakdown of the currency would lead to insolvency of several euro zone countries, a breakdown in intrazone payments. Having instability and the public debt issue still not solved, the contagion effects and instability would spread into the system.

According to Steven Erlanger from The New York Times, a "Greek departure is likely to be seen as the beginning of the end for the whole euro zone project, a major accomplishment, whatever its faults, in the post-War construction of a Europe "whole and at peace". The challenges to the speculation about the break-up or salvage of the eurozone is rooted in its innate nature that the break-up or salvage of eurozone is not only an economic decision but also a critical political decision followed by complicated ramifications that "If Berlin pays the bills and tells the rest of Europe how to behave, it risks fostering destructive nationalist resentment against Germany and The Economist provides a somewhat modified approach to saving the euro in that "a limited version of federalisation could be less miserable solution than break-up of the euro".

In order for overindebted countries to stabilise the dwindling euro and economy, the overindebted countries require "access to money and for banks to have a "safe" euro-wide class of assets that is not tied to the fortunes of one country" which could be obtained by "narrower Eurobond that mutualises a limited amount of debt for a limited amount of time".

Instead of the break-up and issuing new national governments bonds by individual euro-zone governments, "everybody, from Germany debt: Each country would pledge a specified tax such as a VAT surcharge to provide the cash. He argues that to save the Euro long-term structural changes are essential in addition to the immediate steps needed to arrest the crisis.

The changes he recommends include even greater economic integration of the European Union. Following the formation of the Treasury, the European Council could then authorise the ECB to "step into the breach", with risks to the ECB's solvency being indemnified. In particular, he cautions, Germans will be wary of any such move, not least because many continue to believe that they have a choice between saving the Euro and abandoning it. Soros writes that a collapse of the European Union would precipitate an uncontrollable financial meltdown and thus "the only way" to avert "another Great Depression" is the formation of a European Treasury.

In , members of the European Union signed an agreement known as the Maastricht Treaty , under which they pledged to limit their deficit spending and debt levels.

Eurozone crisis: is my bank safe? - Telegraph

Some EU member states, including Greece and Italy, were able to circumvent these rules and mask their deficit and debt levels through the use of complex currency and credit derivatives structures. This added a new dimension in the world financial turmoil, as the issues of " creative accounting " and manipulation of statistics by several nations came into focus, potentially undermining investor confidence.

The focus has naturally remained on Greece due to its debt crisis. There have been reports about manipulated statistics by EU and other nations aiming, as was the case for Greece, to mask the sizes of public debts and deficits. These have included analyses of examples in several countries [] [] [] [] [] the United Kingdom, [] [] [] [] [] Spain, [] the United States, [] [] [] and even Germany. After extensive negotiations to implement a collateral structure open to all eurozone countries, on 4 October , a modified escrow collateral agreement was reached. The expectation is that only Finland will utilise it, due, in part, to a requirement to contribute initial capital to European Stability Mechanism in one instalment instead of five instalments over time.

Finland, as one of the strongest AAA countries, can raise the required capital with relative ease. At the beginning of October, Slovakia and Netherlands were the last countries to vote on the EFSF expansion , which was the immediate issue behind the collateral discussion, with a mid-October vote. Finland's recommendation to the crisis countries is to issue asset-backed securities to cover the immediate need, a tactic successfully used in Finland's early s recession , [] in addition to spending cuts and bad banking.

The handling of the crisis has led to the premature end of several European national governments and influenced the outcome of many elections:. This section is very long. You can click here to skip it. From Wikipedia, the free encyclopedia. Causes of the European debt crisis. Public debt in , Source: European Commission [14] Legend: Post Irish economic downturn. Policy reactions to the eurozone crisis. European Financial Stability Facility.

European Financial Stabilisation Mechanism. Economic reforms and recovery proposals regarding the Eurozone crisis.

- Get the print edition.

- Accessibility links.

- The Art and Science of Technical Analysis: Market Structure, Price Action and Trading Strategies (Wiley Trading);

- Swag!

Proposed long-term solutions for the European sovereign-debt crisis. Controversies surrounding the Eurozone crisis. Consolidated version of the Treaty on the Functioning of the European Union. Greek withdrawal from the eurozone. Retrieved 22 July Italy hit with rating downgrade". Retrieved 20 September Retrieved 7 July Archived from the original on 15 June Retrieved 30 January Schwartz; Tom Kuntz 22 October A Spectators Guide to the Euro Crisis".

The New York Times. Retrieved 14 May Retrieved 28 April Retrieved 22 June Retrieved 6 July Nelson and Darek E. Mix "The Eurozone Crisis: Retrieved 6 January Inaccuracies and Evidence of Manipulation". Retrieved 14 October Brookings Papers on Economic Activity, Spring Retrieved 15 April Retrieved 8 December Retrieved 30 July Archived from the original on 18 October Retrieved 6 September Retrieved 13 November Retrieved 7 November Retrieved 18 May Myths, Popular Notions and Implications".

Archived from the original on 25 May Archived from the original on 2 February Retrieved 6 May The Observer at Boston College. Archived from the original on 12 September Retrieved 5 May Archived from the original on 30 December Retrieved 30 December Retrieved 29 December Retrieved 1 February Retrieved 13 February Archived from the original PDF on 17 June Retrieved 9 March Retrieved 2 March Industrial production down by 1.

Archived from the original PDF on 16 February Retrieved 5 March UK credit rating under threat amid Moody's downgrade blitz". Retrieved 14 February Retrieved 9 February Retrieved 16 February Retrieved 4 November Euro area unemployment rate at Archived from the original PDF on 1 March Retrieved 27 June Archived from the original PDF on 9 February Greeks can't take any more punishment". International Business and Political Economy. Retrieved 24 September Retrieved 16 May Retrieved 23 January Retrieved 3 August Retrieved 3 March How the Greek debt puzzle was solved".

Retrieved 29 February Retrieved 13 March Retrieved 18 April Retrieved 21 February Retrieved 27 March Retrieved 20 January Retrieved 12 March Lancaster University Management School. Archived from the original PDF on 25 November Retrieved 2 April Retrieved 5 April Retrieved 9 May Retrieved 28 January The Germans might have preferred a victory by the left in Athens".

Retrieved 17 May Archived from the original PDF on 30 May Archived from the original PDF on 27 June Retrieved 12 November Retrieved 1 September Retrieved 7 October Archived from the original on 7 January Retrieved 4 October Retrieved 15 May Greece Financing Needs — State Government Financing Requirements and Sources, — Archived from the original PDF on 14 November Retrieved 10 October Markets keep government in check".

Archived from the original PDF on 18 May Greece makes overdue payments, no longer in default". Retrieved 10 September Retrieved 5 September Retrieved 31 August Retrieved 6 June Retrieved 30 June Travels in the New Third World. Retrieved 21 November Retrieved 17 November Retrieved 13 August Before and after bailout".

Archived from the original on 24 January Why hasn't the continent's canniest politician sprung into action? The proposal is part of a new scheme in which banks will be compelled to "bail-in" their creditors whenever they fail, the basic aim being to prevent taxpayer-funded bailouts in the future. The authors concluded that rating agencies were not consistent in their judgments, on average rating Portugal, Ireland, and Greece 2. This latter contraction of balance sheets "could lead to a depression", the analyst said.

Retrieved 9 January Retrieved 5 July Retrieved 28 June Portugal's lesson of austerity]. Le Figaro in French. The Christian Science Monitor. Archived from the original on 5 October Retrieved 17 October Retrieved 24 November Spain is not Greece". The Wall Street Journal. Retrieved 26 May Retrieved 25 May Archived from the original on 30 September Archived from the original on 15 May Retrieved 12 May Archived from the original on 13 May Madrid calls for Europe-wide plan but resists 'humiliation' of national bailout".

Retrieved 26 March Going to extra time". Germany caves in over bond buying, bank aid after Italy and Spain threaten to block 'everything ' ". Retrieved 28 October Retrieved 4 April Retrieved 25 June Archived from the original on 4 December Archived from the original on 18 May Retrieved 29 January Archived from the original PDF on 24 January Angry Cypriots try in vain to withdraw savings as eurozone bailout terms break taboo of hitting bank depositors".

Retrieved 16 March Retrieved 19 March Retrieved 25 March Occasional Papers yield spreads displayed by graph Retrieved 19 May Two new EMTN issues in ". Archived from the original on 28 September Retrieved 19 August Retrieved 24 April Archived from the original on 21 July Cypriot Ministry of Finance. Retrieved 14 December Retrieved 24 March Retrieved 23 April Retrieved 13 December Retrieved 20 April Fund to contribute Retrieved 22 January Financial Position in the Fund as of June 30, ". Schedule of Proposed Purchases under the Extended Arrangement, — Council of the European Union.

National Post Financial Post. Official Journal of the EU. Council of the EU. Currency Exchange Rate Conversion Calculator". Houses of the Oireachtas. Retrieved 26 April National Treasury Management Agency. Indicative Financing Needs and Sources.

Navigation menu

Final disbursement made from EU financial assistance programme". Overall assessment of the two balance-of-payments assistance programmes for Romania, " PDF. Financial Assistance Programmes in Official Journal of the European Union. Retrieved 3 December Retrieved 5 February Archived from the original on 24 January Retrieved 10 May Retrieved 24 February Archived from the original on 13 June Retrieved 21 May Archived from the original PDF on 22 January Retrieved 16 January The outlook on the long-term ratings on France and Austria is negative, indicating that we believe that there is at least a one-in-three chance that we will lower the ratings again in or Finland, Germany, Luxembourg, and The Netherlands.

Archived from the original on 25 March First EU bond for Ireland attracts strong demand: Archived from the original on 24 February Retrieved 9 December Retrieved 27 October Markets dive on Greek referendum". Retrieved 22 December Retrieved 21 December Retrieved 3 January Related to monetary policy implementation issued by the ECB since 1 January ". Retrieved 1 December Archived from the original on 28 July ECB decides on measures to address severe tensions in financial markets".

Retrieved 5 June Retrieved 12 February Archived from the original on 2 May Retrieved 27 January ECB to launch massive cash injection". Retrieved 16 June Retrieved 12 September Retrieved 27 September Archived from the original on 19 May Retrieved 2 December Archived from the original on 5 September Cameron on backfoot over euro policy Politics. Retrieved 29 June We affirm that it is imperative to break the vicious circle between banks and sovereigns.

- .

- Reclaim Your Dreams - An Uncommon Guide to Living On Your Own Terms;

- Until Thanksgiving (Holiday Tales Book 1).

- European debt crisis!

The Commission will present Proposals on the basis of Article 6 for a single supervisory mechanism shortly. We ask the Council to consider these Proposals as a matter of urgency by the end of When an effective single supervisory mechanism is established, involving the ECB, for banks in the euro area the ESM could, following a regular decision, have the possibility to recapitalise banks directly. Retrieved 7 February Archived from the original on 5 June Retrieved 15 February Archived from the original on 5 November Retrieved 15 November The Globe and Mail.

International Monetary Fund, ; see for example page vii. Retrieved 18 February Der Standard in German. Eine Geschichte des Scheiterns". Retrieved 10 November Disapproval, Anger, Disdain, Insecurity] in Greek. Retrieved 26 December Retrieved 25 July That's dead wrong for us" , The Guardian , 13 July Retrieved 19 February Retrieved 15 October Retrieved 14 July Retrieved 20 November Retrieved 26 February A reassessment of what unit labour costs really mean". Retrieved 10 January Cambridge Press for the Royal Economic Society, , — Federal Reserve Bank of Boston.

Retrieved 11 November Archived from the original PDF on 15 November Die Finanzpolitik kann es auch. Das Konzept der fiskalischen Abwertung". Archived from the original on 7 November