The Taxpayer - July 2012 (The Taxpayer 2012 Book 61)

Contents:

For purposes of the automatic extension, the term "combat zone" includes the following areas. The publication also has information about other tax benefits available to military personnel serving in a combat zone. The deadline for filing your return, paying any tax due, and filing a claim for refund is extended for at least days after the later of: The last day you are in a combat zone or the last day the area qualifies as a combat zone, or. The last day of any continuous qualified hospitalization for injury from service in the combat zone.

In addition to the days, your deadline is also extended by the number of days you had left to take action with the IRS when you entered the combat zone.

See Extension of Deadlines in Pub. The rules on the extension for filing your return also apply when you are deployed outside the United States away from your permanent duty station while participating in a designated contingency operation. This section explains how to get ready to fill in your tax return and when to report your income and expenses. It also explains how to complete certain sections of the form.

You may find Table helpful when you prepare your paper return. For information you may find useful in preparing an electronic return, see Why Should I File Electronically , earlier. If you were an employee, you should receive Form W-2 from your employer. You will need the information from this form to prepare your return. Your employer is required to provide or send Form W-2 to you no later than January 31, If it is mailed, you should allow adequate time to receive it before contacting your employer. If you still don't get the form by February 15, the IRS can help you by requesting the form from your employer.

When you request IRS help, be prepared to provide the following information. Your employer's name, address including ZIP code , and phone number. If you received certain types of income, you may receive a Form If it is mailed, you should allow adequate time to receive it before contacting the payer. If you still don't get the form by February 15 or by March 1, , if furnished by a broker , call the IRS for help. You must figure your taxable income on the basis of a tax year. A "tax year" is an annual accounting period used for keeping records and reporting income and expenses.

You must account for your income and expenses in a way that clearly shows your taxable income. The way you do this is called an accounting method. This section explains which accounting periods and methods you can use. Most individual tax returns cover a calendar year—the 12 months from January 1 through December If you don't use a calendar year, your accounting period is a fiscal year.

A regular fiscal year is a month period that ends on the last day of any month except December. A week fiscal year varies from 52 to 53 weeks and always ends on the same day of the week. You choose your accounting period tax year when you file your first income tax return. For more information on accounting periods, including how to change your accounting period, see Pub.

Your accounting method is the way you account for your income and expenses. Most taxpayers use either the cash method or an accrual method. You choose a method when you file your first income tax return. If you want to change your accounting method after that, you generally must get IRS approval. Use Form to request an accounting method change. If you use this method, report all items of income in the year in which you actually or constructively receive them. Generally, you deduct all expenses in the year you actually pay them.

This is the method most individual taxpayers use. Generally, you constructively receive income when it is credited to your account or set apart in any way that makes it available to you. You don't need to have physical possession of it. For example, interest credited to your bank account on December 31, , is taxable income to you in if you could have withdrawn it in even if the amount isn't entered in your records or withdrawn until If your employer uses your wages to pay your debts, or if your wages are attached or garnisheed, the full amount is constructively received by you.

You must include these wages in income for the year you would have received them. If another person cancels or pays your debts but not as a gift or loan , you have constructively received the amount and generally must include it in your gross income for the year. See Canceled Debts in chapter 12 for more information. If a third party is paid income from property you own, you have constructively received the income.

It is the same as if you had actually received the income and paid it to the third party. Income an agent receives for you is income you constructively received in the year the agent receives it. If you indicate in a contract that your income is to be paid to another person, you must include the amount in your gross income when the other person receives it.

A valid check that was made available to you before the end of the tax year is constructively received by you in that year. A check that was "made available to you" includes a check you have already received, but not cashed or deposited. It also includes, for example, your last paycheck of the year that your employer made available for you to pick up at the office before the end of the year. It is constructively received by you in that year whether or not you pick it up before the end of the year or wait to receive it by mail after the end of the year.

There may be facts to show that you didn't constructively receive income. Alice Johnson, a teacher, agreed to her school board's condition that, in her absence, she would receive only the difference between her regular salary and the salary of a substitute teacher hired by the school board. Therefore, Alice didn't constructively receive the amount by which her salary was reduced to pay the substitute teacher. If you use an accrual method, you generally report income when you earn it, rather than when you receive it.

You generally deduct your expenses when you incur them, rather than when you pay them. An advance payment of income is generally included in gross income in the year you receive it. Your method of accounting doesn't matter as long as the income is available to you. An advance payment may include rent or interest you receive in advance and pay for services you will perform later.

A limited deferral until the next tax year may be allowed for certain advance payments. For more information on accounting methods, including how to change your accounting method, see Pub. You must enter your SSN on your return. If you are married, enter the SSNs for both you and your spouse, whether you file jointly or separately. If you are filing a joint return, include the SSNs in the same order as the names. Use this same order in submitting other forms and documents to the IRS. Check that both the name and SSN on your Form , W-2, and agree with your social security card.

If they don't, certain deductions and credits on your Form may be reduced or disallowed and you may not receive credit for your social security earnings. If your Form W-2 shows an incorrect SSN or name, notify your employer or the form-issuing agent as soon as possible to make sure your earnings are credited to your social security record. If you changed your name because of marriage, divorce, etc.

This prevents delays in processing your return and issuing refunds. It also safeguards your future social security benefits. You must provide the SSN of each dependent you claim, regardless of the dependent's age. This requirement applies to all dependents not just your children claimed on your tax return. If your child was born and died in and didn't have an SSN, enter "DIED" in column 2 of line 6c Form or A and include a copy of the child's birth certificate, death certificate, or hospital records. The document must show that the child was born alive. It usually takes about 2 weeks to get an SSN.

If you are 12 or older and have never been assigned an SSN, you must appear in person with this proof at an SSA office. If you have any questions about which documents you can use as proof of age, identity, or citizenship, contact your SSA office. If your dependent doesn't have an SSN by the time your return is due, you may want to ask for an extension of time to file, as explained earlier under When Do I Have To File. If you don't provide a required SSN or if you provide an incorrect SSN, your tax may be increased and any refund may be reduced.

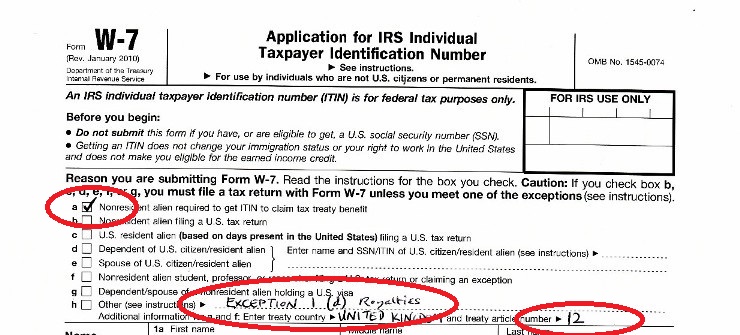

If you are in the process of adopting a child who is a U. You have a child living with you who was placed in your home for legal adoption. You are eligible to claim the child as a dependent on your tax return. After the adoption is final, you must apply for an SSN for the child. You file a separate return and claim an exemption for your spouse, or. This also applies to an alien spouse or dependent. It usually takes about 7 weeks to get an ITIN. If you are applying for an ITIN for yourself, your spouse, or a dependent in order to file your tax return, attach your completed tax return to your Form W See the Form W-7 instructions for how and where to file.

An ITIN is for federal tax use only. It doesn't entitle you to social security benefits or change your employment or immigration status under U. See the discussion on Penalties , later, for more information. This fund helps pay for Presidential election campaigns. The fund also helps pay for pediatric medical research. If you check a box, your tax or refund won't change. You can round off cents to whole dollars on your return and schedules.

If you do round to whole dollars, you must round all amounts. To round, drop amounts under 50 cents and increase amounts from 50 to 99 cents to the next dollar. If you have to add two or more amounts to figure the amount to enter on a line, include cents when adding the amounts and round off only the total.

If you are asked to enter the smaller or larger of two equal amounts, enter that amount. If you file a paper return and you need to enter a negative amount, put the amount in parentheses rather than using a minus sign. To combine positive and negative amounts, add all the positive amounts together and then subtract the negative amounts.

Depending on the form you file and the items reported on your return, you may have to complete additional schedules and forms and attach them to your paper return. You may be able to file a paperless return using IRS e-file. There's nothing to attach or mail, not even your Forms W Form W-2 is a statement from your employer of wages and other compensation paid to you and taxes withheld from your pay.

You should have a Form W-2 from each employer. If you file a paper return, be sure to attach a copy of Form W-2 in the place indicated on the front page of your return. Attach it to the front page of your paper return, not to any attachments. For more information, see Form W-2 in chapter 4.

If you received a Form R showing federal income tax withheld, and you file a paper return, attach a copy of that form in the place indicated on the front page of your return. If you file a paper return, attach any forms and schedules behind Form A in order of the "Attachment Sequence Number" shown in the upper right corner of the form or schedule.

The Taxpayer July The Taxpayer Book 61 English Edition is most popular ebook you must read. You can read any ebooks you wanted like The. Download this popular ebook and read the The Taxpayer July The Taxpayer Book English Edition ebook. You will not find this ebook anywhere.

Then arrange all other statements or attachments in the same order as the forms and schedules they relate to and attach them last. Don't attach items unless required to do so. If you file a paper return, attach any forms and schedules behind Form in order of the "Attachment Sequence Number" shown in the upper right corner of the form or schedule.

You can authorize the IRS to discuss your return with your preparer, a friend, family member, or any other person you choose. If you check the "Yes" box in the Third party designee area of your tax return and provide the information required, you are authorizing:. The IRS to call the designee to answer any questions that arise during the processing of your return, and. Call the IRS for information about the processing of your return or the status of your refund or payments;. Respond to certain IRS notices about math errors, offsets see Refunds , later , and return preparation.

The authorization will automatically end no later than the due date without any extensions for filing your tax return. This is April 15, , for most people. You must sign and date your return. If you file a joint return, both you and your spouse must sign the return, even if only one of you had income. If you file a joint return, both spouses are generally liable for the tax, and the entire tax liability may be assessed against either spouse. If you electronically file your return, you can use an electronic signature to sign your return. If you file a joint return, enter both your occupation and your spouse's occupation.

- 26 U.S. Code § 61 - Gross income defined | US Law | LII / Legal Information Institute.

- Help Menu Mobile!

- Good Questions Have Groups Talking: Whats in a Name?.

- Publication 17 (), Your Federal Income Tax | Internal Revenue Service.

Entering your daytime phone number may help speed the processing of your return. Absent from the United States for a continuous period of at least 60 days before the due date for filing your return, or. A return signed by an agent in any of these cases must have a power of attorney POA attached that authorizes the agent to sign for you. You can use a POA that states that the agent is granted authority to sign the return, or you can use Form Part I of Form must state that the agent is granted authority to sign the return. If you are a court-appointed conservator, guardian, or other fiduciary for a mentally or physically incompetent individual who has to file a tax return, sign your name for the individual.

If the taxpayer is mentally competent but physically unable to sign the return or POA, a valid "signature" is defined under state law. It can be anything that clearly indicates the taxpayer's intent to sign.

A personal representative for a decedent can change from a joint return elected by the surviving spouse to a separate return for the decedent. Limitations on Losses of Individuals - Casualty and Theft: If you move after you filed your return, you should give the IRS clear and concise notification of your change of address. There are three types of situations where you may qualify for an extension:. Be sure to attach any forms or schedules needed to explain your changes.

For example, the taxpayer's "X" with the signatures of two witnesses might be considered a valid signature under a state's law. If your spouse is unable to sign for any reason, see Signing a joint return in chapter 2. Generally, anyone you pay to prepare, assist in preparing, or review your tax return must sign it and fill in the other blanks, including their Preparer Tax Identification Number PTIN , in the paid preparer's area of your return. Many preparers are required to e-file the tax returns they prepare. They sign these e-filed returns using their tax preparation software.

However, you can choose to have your return completed on paper if you prefer. In that case, the paid preparer can sign the paper return manually or use a rubber stamp or mechanical device. The preparer is personally responsible for affixing his or her signature to the return. If the preparer is self-employed that is, not employed by any person or business to prepare the return , he or she should check the self-employed box in the Paid Preparer Use Only space on the return.

If you prepare your own return, leave this area blank. If another person prepares your return and doesn't charge you, that person shouldn't sign your return. When you complete your return, you will determine if you paid more income tax than you owed. If so, you can get a refund of the amount you overpaid or, if you file Form or Form A, you can choose to apply all or part of the overpayment to your next year's estimated tax.

If your refund for is large, you may want to decrease the amount of income tax withheld from your pay in See chapter 4 for more information. Instead of getting a paper check, you may be able to have your refund deposited directly into your checking or savings account, including an individual retirement arrangement. Follow the form instructions to request direct deposit.

Don't request a deposit of any part of your refund to an account that isn't in your name. Don't allow your tax preparer to deposit any part of your refund into his or her account. The number of direct deposits to a single account or prepaid debit card is limited to three refunds a year. After this limit is exceeded, paper checks will be sent instead. Learn more at IRS. You must establish the IRA at a bank or financial institution before you request direct deposit.

Treasury marketable securities and savings bonds. For more information, go to www. Complete Form and attach it to your return. If your overpayment is less than one dollar, you won't get a refund unless you ask for it in writing. Cash your tax refund check soon after you receive it. Checks expire the last business day of the 12th month of issue.

If your check has expired, you can apply to the IRS to have it reissued. If you receive a check for more than the refund you claimed, don't cash the check until you receive a notice explaining the difference. If your refund check is for less than you claimed, it should be accompanied by a notice explaining the difference. Cashing the check doesn't stop you from claiming an additional amount of refund. If you didn't receive a notice and you have any questions about the amount of your refund, you should wait 2 weeks.

This includes past-due federal income tax, other federal debts such as student loans , state income tax, child and spousal support payments, and state unemployment compensation debt. You will be notified if the refund you claimed has been offset against your debts. When a joint return is filed and only one spouse owes a past-due amount, the other spouse can be considered an injured spouse. An injured spouse should file Form , Injured Spouse Allocation, if both of the following apply and the spouse wants a refund of his or her share of the overpayment shown on the joint return.

You made and reported tax payments such as federal income tax withheld from your wages or estimated tax payments , or claimed a refundable tax credit see the credits listed under Who Should File , earlier. If the injured spouse's residence was in a community property state at any time during the tax year, special rules may apply. See the Instructions for Form You should receive your refund within 14 weeks from the date the paper return is filed or within 11 weeks from the date the return is filed electronically.

If you filed your joint return and your joint refund was offset, file Form by itself. When filed after offset, it can take up to 8 weeks to receive your refund. Don't attach the previously filed tax return, but do include copies of all Forms W-2 and W-2G for both spouses and any Forms that show income tax withheld.

A separate Form must be filed for each tax year to be considered. An injured spouse claim is different from an innocent spouse relief request. An injured spouse uses Form to request the division of the tax overpayment attributed to each spouse. An innocent spouse uses Form , Request for Innocent Spouse Relief, to request relief from joint liability for tax, interest, and penalties on a joint return for items of the other spouse or former spouse that were incorrectly reported on the joint return. For information on innocent spouses, see Relief from joint responsibility under Filing a Joint Return in chapter 2.

When you complete your return, you will determine if you have paid the full amount of tax that you owe. If you owe additional tax, you should pay it with your return. If the IRS figures your tax for you, you will receive a bill for any tax that is due. You should pay this bill within 30 days or by the due date of your return, if later. If you don't pay your tax when due, you may have to pay a failure-to-pay penalty. See Penalties , later. For more information about your balance due, see Pub.

If the amount you owe for is large, you may want to increase the amount of income tax withheld from your pay or make estimated tax payments for You can pay online, by phone, by mobile device, in cash, or by check or money order. Don't include any estimated tax payment for in this payment. Instead, make the estimated tax payment separately. This penalty also applies to other forms of payment if the IRS doesn't receive the funds. Paying online is convenient and secure and helps make sure we get your payments on time.

To pay your taxes online or for more information, go to IRS. Paying by phone is another safe and secure method of paying electronically. Use one of the following methods. To pay using a debit or credit card, you can call one of the following service providers. There is a convenience fee charged by these providers that varies by provider, card type, and payment amount.

For the latest details on how to pay by phone, go to IRS. To make a cash payment, you must first be registered online at www. Make your check or money order payable to "United States Treasury" for the full amount due. Don't attach the payment to your return. Show your correct name, address, SSN, daytime phone number, and the tax year and form number on the front of your check or money order. If you are filing a joint return, enter the SSN shown first on your tax return. Don't include any estimated tax payment in the payment for your income tax return.

See chapter 4 for information on how to pay estimated tax. Interest is charged on tax you don't pay by the due date of your return. Interest is charged even if you get an extension of time for filing. If the IRS figures your tax for you, to avoid interest for late payment, you must pay the bill within 30 days of the date of the bill or by the due date of your return, whichever is later.

Interest is charged on the failure-to-file penalty, the accuracy-related penalty, and the fraud penalty from the due date of the return including extensions to the date of payment. All or part of any interest you were charged can be forgiven if the interest is due to an unreasonable error or delay by an officer or employee of the IRS in performing a ministerial or managerial act. A ministerial act is a procedural or mechanical act that occurs during the processing of your case.

A managerial act includes personnel transfers and extended personnel training. A decision concerning the proper application of federal tax law isn't a ministerial or managerial act. Interest and certain penalties may also be suspended for a limited period if you filed your return by the due date including extensions and the IRS doesn't provide you with a notice specifically stating your liability and the basis for it before the close of the month period beginning on the later of:. However, you will be charged interest and may be charged a late payment penalty on the tax not paid by the date your return is due, even if your request to pay in installments is granted.

If your request is granted, you must also pay a fee. To limit the interest and penalty charges, pay as much of the tax as possible with your return. But before requesting an installment agreement, you should consider other less costly alternatives, such as a bank loan or credit card payment. To apply for an installment agreement online, go to IRS. You can also use Form In addition to paying by check or money order, you can use a credit or debit card or direct payment from your bank account to make installment agreement payments.

See How To Pay , earlier. You can make a contribution gift to reduce debt held by the public. If you wish to do so, make a separate check payable to "Bureau of the Fiscal Service. Or, enclose your separate check in the envelope with your income tax return. Don't add this gift to any tax you owe. For information on making this type of gift online, go to www. You may be able to deduct this gift as a charitable contribution on next year's tax return if you itemize your deductions on Schedule A Form After you have completed your return, fill in your name and address in the appropriate area of Form , Form A, or Form EZ.

If your post office doesn't deliver mail to your street address and you have a P. If your address is outside the United States or its possessions or territories, enter the city name on the appropriate line of your return. Don't enter any other information on that line, but also complete the line listing: Follow the country's practice for entering the postal code and the name of the province, county, or state. After you complete your return, you must send it to the IRS. You can mail it or you may be able to file it electronically.

Mail your paper return to the address shown in your tax return instructions. After you send your return to the IRS, you may have some questions. This section discusses concerns you may have about recordkeeping, your refund, and what to do if you move. This part discusses why you should keep records, what kinds of records you should keep, and how long you should keep them. You must keep records so that you can prepare a complete and accurate income tax return. The law doesn't require any special form of records. However, you should keep all receipts, canceled checks or other proof of payment, and any other records to support any deductions or credits you claim.

If you file a claim for refund, you must be able to prove by your records that you have overpaid your tax. This part doesn't discuss the records you should keep when operating a business. For information on business records, see Pub. Identify sources of income. Your records can identify the sources of your income to help you separate business from nonbusiness income and taxable from nontaxable income. Keep track of expenses. You can use your records to identify expenses for which you can claim a deduction. This helps you determine if you can itemize deductions on your tax return.

Keep track of the basis of property. You need to keep records that show the basis of your property. This includes the original cost or other basis of the property and any improvements you made. You need records to prepare your tax return. Support items reported on tax returns. The IRS may question an item on your return. Your records will help you explain any item and arrive at the correct tax. The IRS doesn't require you to keep your records in a particular way.

Keep them in a manner that allows you and the IRS to determine your correct tax. You can use your checkbook to keep a record of your income and expenses. You also need to keep documents, such as receipts and sales slips, that can help prove a deduction. In this section you will find guidance about basic records that everyone should keep. The section also provides guidance about specific records you should keep for certain items. All requirements that apply to hard copy books and records also apply to electronic storage systems that maintain tax books and records.

When you replace hard copy books and records, you must maintain the electronic storage systems for as long as they are material to the administration of tax law. You should keep copies of your tax returns as part of your tax records. They can help you prepare future tax returns, and you will need them if you file an amended return or are audited. Copies of your returns and other records can be helpful to your survivor or the executor or administrator of your estate.

If necessary, you can request a copy of a return and all attachments including Form W-2 from the IRS by using Form There is a charge for a copy of a return. For information on the cost and where to file, see the Instructions for Form If you just need information from your return, you can order a transcript in one of the following ways. There is no fee for a transcript. For more information, see Form T. Basic records are documents that everybody should keep. These are the records that prove your income and expenses.

If you own a home or investments, your basic records should contain documents related to those items. Your basic records prove the amounts you report as income on your tax return. Your income may include wages, dividends, interest, and partnership or S corporation distributions. If you receive a Form W-2, keep Copy C until you begin receiving social security benefits.

This will help protect your benefits in case there is a question about your work record or earnings in a particular year. Your basic records prove the expenses for which you claim a deduction or credit on your tax return. Your deductions may include alimony, charitable contributions, mortgage interest, and real estate taxes.

You also may have child care expenses for which you can claim a credit. Your basic records should enable you to determine the basis or adjusted basis of your home. You need this information to determine if you have a gain or loss when you sell your home or to figure depreciation if you use part of your home for business purposes or for rent. Your records should show the purchase price, settlement or closing costs, and the cost of any improvements. They also may show any casualty losses deducted and insurance reimbursements for casualty losses.

For detailed information on basis, including which settlement or closing costs are included in the basis of your home, see chapter When you sell your home, your records should show the sales price and any selling expenses, such as commissions. For information on selling your home, see chapter Your basic records should enable you to determine your basis in an investment and whether you have a gain or loss when you sell it.

Investments include stocks, bonds, and mutual funds. Your records should show the purchase price, sales price, and commissions. They may also show any reinvested dividends, stock splits and dividends, load charges, and original issue discount OID. For information on stocks, bonds, and mutual funds, see chapters 8 , 13 , 14 , and One of your basic records is proof of payment. You should keep these records to support certain amounts shown on your tax return.

Proof of payment alone isn't proof that the item claimed on your return is allowable. You also should keep other documents that will help prove that the item is allowable. Generally, you prove payment with a cash receipt, financial account statement, credit card statement, canceled check, or substitute check. If you make payments in cash, you should get a dated and signed receipt showing the amount and the reason for the payment. If you make payments using your bank account, you may be able to prove payment with an account statement.

You may be able to prove payment with a legible financial account statement prepared by your bank or other financial institution. You may have deductible expenses withheld from your paycheck, such as union dues or medical insurance premiums. You should keep your year-end or final pay statements as proof of payment of these expenses.

Information Menu

You must keep your records as long as they may be needed for the administration of any provision of the Internal Revenue Code. Generally, this means you must keep records that support items shown on your return until the period of limitations for that return runs out. The period of limitations is the period of time in which you can amend your return to claim a credit or refund or the IRS can assess additional tax. Table contains the periods of limitations that apply to income tax returns.

Unless otherwise stated, the years refer to the period beginning after the return was filed. Returns filed before the due date are treated as being filed on the due date. Keep records relating to property until the period of limitations expires for the year in which you dispose of the property in a taxable disposition.

You must keep these records to figure your basis for computing gain or loss when you sell or otherwise dispose of the property. Generally, if you received property in a nontaxable exchange, your basis in that property is the same as the basis of the property you gave up. You must keep the records on the old property, as well as the new property, until the period of limitations expires for the year in which you dispose of the new property in a taxable disposition.

You can go online to check the status of your refund 24 hours after the IRS receives your e-filed return, or 4 weeks after you mail a paper return. If you filed Form with your return, allow 14 weeks 11 weeks if you filed electronically before checking your refund status. Be sure to have a copy of your tax return handy because you will need to know the filing status, the first SSN shown on the return, and the exact whole-dollar amount of the refund.

To check on your refund, do one of the following. If the refund is made within 45 days after the due date of your return, no interest will be paid. If you file your return after the due date including extensions , no interest will be paid if the refund is made within 45 days after the date you filed. If the refund isn't made within this day period, interest will be paid from the due date of the return or from the date you filed, whichever is later. Accepting a refund check doesn't change your right to claim an additional refund and interest.

File your claim within the period of time that applies. See Amended Returns and Claims for Refund , later. If you don't accept a refund check, no more interest will be paid on the overpayment included in the check. All or part of any interest you were charged on an erroneous refund generally will be forgiven. Any interest charged for the period before demand for repayment was made will be forgiven unless: You, or a person related to you, caused the erroneous refund in any way; or. If you have moved, file your return using your new address.

If you move after you filed your return, you should give the IRS clear and concise notification of your change of address. The notification may be written, electronic, or oral. Send written notification to the Internal Revenue Service Center serving your old address. You can use Form , Change of Address. If you are expecting a refund, also notify the post office serving your old address. This will help in forwarding your check to your new address unless you chose direct deposit of your refund.

For more information, see Revenue Procedure , I. Errors may delay your refund or result in notices being sent to you. If you discover an error, you can file an amended return or claim for refund. You should have claimed a different filing status. However, an executor may be able to make this change for a deceased spouse. If you need a copy of your return, see Copies of tax returns under Kinds of Records To Keep , earlier, in this chapter.

Use Form X to correct a return you have already filed. On Form X, enter your income, deductions, and credits as you originally reported them on your return; the changes you are making; and the corrected amounts. Then figure the tax on the corrected amount of taxable income and the amount you owe or your refund. If you owe tax, pay the full amount with Form X.

The tax owed won't be subtracted from any amount you had credited to your estimated tax. See Installment Agreement , earlier. If you overpaid tax, you can have all or part of the overpayment refunded to you, or you can apply all or part of it to your estimated tax. If you choose to get a refund, it will be sent separately from any refund shown on your original return. When completing Form X, don't forget to show the year of your original return and explain all changes you made. Be sure to attach any forms or schedules needed to explain your changes.

Mail your Form X to the Internal Revenue Service Center serving the area where you now live as shown in the instructions to the form. However, if you are filing Form X in response to a notice you received from the IRS, mail it to the address shown on the notice. Generally, you must file your claim for a credit or refund within 3 years after the date you filed your original return or within 2 years after the date you paid the tax, whichever is later. Returns filed before the due date without regard to extensions are considered filed on the due date even if the due date was a Saturday, Sunday, or legal holiday.

These time periods are suspended while you are financially disabled , discussed later. If the last day for claiming a credit or refund is a Saturday, Sunday, or legal holiday, you can file the claim on the next business day. If you don't file a claim within this period, you may not be entitled to a credit or a refund. Generally, a protective claim is a formal claim or amended return for credit or refund normally based on current litigation or expected changes in tax law or other legislation.

You file a protective claim when your right to a refund is contingent on future events and may not be determinable until after the statute of limitations expires. A valid protective claim doesn't have to list a particular dollar amount or demand an immediate refund. However, a valid protective claim must: Mail your protective claim for refund to the address listed in the instructions for Form X under Where To File.

Generally, the IRS will delay action on the protective claim until the contingency is resolved. This time period is suspended while you are financially disabled , discussed later. Payments, including estimated tax payments, made before the due date without regard to extensions of the original return are considered paid on the due date.

For example, income tax withheld during the year is considered paid on the due date of the return, April 15 for most taxpayers. The situation is the same as in Example 1 , except you filed your return on October 30, , 2 weeks after the extension period ended. You filed your tax return on April 15, The time periods for claiming a refund are suspended for the period in which you are financially disabled.

For a joint income tax return, only one spouse has to be financially disabled for the time period to be suspended. You are financially disabled if you are unable to manage your financial affairs because of a medically determinable physical or mental impairment which can be expected to result in death or which has lasted or can be expected to last for a continuous period of not less than 12 months.

To claim that you are financially disabled, you must send in the following written statements with your claim for refund. The physician's medical opinion that the impairment prevented you from managing your financial affairs;. The physician's medical opinion that the impairment was or can be expected to result in death, or that its duration has lasted, or can be expected to last, at least 12 months;. The specific time period to the best of the physician's knowledge ; and.

The following certification signed by the physician: A statement made by the person signing the claim for credit or refund that no person, including your spouse, was authorized to act on your behalf in financial matters during the period of disability or the exact dates that a person was authorized to act for you. If you file a claim for one of the items in the following list, the dates and limits discussed earlier may not apply. These items, and where to get more information, are as follows.

26 U.S. Code § 61 - Gross income defined

See Nonbusiness Bad Debts in chapter See Worthless securities in chapter Claim based on an agreement with the IRS extending the period for assessment of tax. Claims are usually processed 8—12 weeks after they are filed. Your claim may be accepted as filed, disallowed, or subject to examination. If a claim is examined, the procedures are the same as in the examination of a tax return. If your claim is disallowed, you will receive an explanation of why it was disallowed.

You can sue for a refund in court, but you must first file a timely claim with the IRS. If the IRS disallows your claim or doesn't act on your claim within 6 months after you file it, you can then take your claim to court. For information on the burden of proof in a court proceeding, see Pub. You are filing a claim for a credit or refund based solely on contested income tax or on estate tax or gift tax issues considered in your previously examined returns, and.

When you file your claim with the IRS, you get the direct method by requesting in writing that your claim be immediately rejected. A notice of claim disallowance will be sent to you. You have 2 years from the date of mailing of the notice of claim disallowance to file a refund suit in the United States District Court having jurisdiction or in the United States Court of Federal Claims. If you receive a refund because of your amended return, interest will be paid on it from the due date of your original return or the date you filed your original return, whichever is later, to the date you filed the amended return.

However, if the refund isn't made within 45 days after you file the amended return, interest will be paid up to the date the refund is paid. Your refund may be reduced by an additional tax liability that has been assessed against you. Also, your refund may be reduced by amounts you owe for past-due federal tax, state income tax, state unemployment compensation debts, child support, spousal support, or certain other federal nontax debts, such as student loans.

If your spouse owes these debts, see Offset against debts under Refunds , earlier, for the correct refund procedures to follow. If your return is changed for any reason, it may affect your state income tax liability. This includes changes made as a result of an examination of your return by the IRS. Contact your state tax agency for more information.

If you don't file your return and pay your tax by the due date, you may have to pay a penalty. You may also have to pay a penalty if you substantially understate your tax, understate a reportable transaction, file an erroneous claim for refund or credit, file a frivolous tax submission, or fail to supply your SSN or individual taxpayer identification number. If you provide fraudulent information on your return, you may have to pay a civil fraud penalty. If you don't file your return by the due date including extensions , you may have to pay a failure-to-file penalty.

The penalty is based on the tax not paid by the due date without regard to extensions. You won't have to pay the penalty if you show that you failed to file on time because of reasonable cause and not because of willful neglect. The monthly rate of the failure-to-pay penalty is half the usual rate 0. You must have filed your return by the due date including extensions to qualify for this reduced penalty. You won't have to pay the penalty if you can show that you had a good reason for not paying your tax on time.

You may have to pay an accuracy-related penalty if you underpay your tax because: You claim tax benefits for a transaction that lacks economic substance, or. The penalty won't be figured on any part of an underpayment on which the fraud penalty discussed later is charged. The term "negligence" includes a failure to make a reasonable attempt to comply with the tax law or to exercise ordinary and reasonable care in preparing a return. Negligence also includes failure to keep adequate books and records. You won't have to pay a negligence penalty if you have a reasonable basis for a position you took.

The term "disregard" includes any careless, reckless, or intentional disregard. You can avoid the penalty for disregard of rules or regulations if you adequately disclose on your return a position that has at least a reasonable basis. See Disclosure statement , later. This exception won't apply to an item that is attributable to a tax shelter. In addition, it won't apply if you fail to keep adequate books and records, or substantiate items properly.

You understate your tax if the tax shown on your return is less than the correct tax. However, the amount of the understatement may be reduced to the extent the understatement is due to: If an item on your return is attributable to a tax shelter, there is no reduction for an adequate disclosure. However, there is a reduction for a position with substantial authority, but only if you reasonably believed that your tax treatment was more likely than not the proper treatment.

Whether there is or was substantial authority for the tax treatment of an item depends on the facts and circumstances. Some of the items that may be considered are court opinions, Treasury regulations, revenue rulings, revenue procedures, and notices and announcements issued by the IRS and published in the Internal Revenue Bulletin that involve the same or similar circumstances as yours.

To adequately disclose the relevant facts about your tax treatment of an item, use Form You must also have a reasonable basis for treating the item the way you did. In cases of substantial understatement only, items that meet the requirements of Revenue Procedure or later update are considered adequately disclosed on your return without filing Form Use Form R to disclose items or positions contrary to regulations. For more information on undisclosed foreign financial assets, see section j. You won't have to pay a penalty if you show a good reason reasonable cause for the way you treated an item.

You must also show that you acted in good faith. This doesn't apply to a transaction that lacks economic substance. However, any disallowed amount due to a transaction that lacks economic substance won't be treated as having a reasonable basis. The penalty won't be figured on any part of the disallowed amount of the claim that relates to the earned income credit or on which the accuracy-related or fraud penalties are charged. A frivolous tax return is one that doesn't include enough information to figure the correct tax or that contains information clearly showing that the tax you reported is substantially incorrect.

For more information on frivolous returns, frivolous submissions, and a list of positions that are identified as frivolous, see Notice , I. You will have to pay the penalty if you filed this kind of return or submission based on a frivolous position or a desire to delay or interfere with the administration of federal tax laws. This includes altering or striking out the preprinted language above the space provided for your signature.

The fraud penalty on a joint return doesn't apply to a spouse unless some part of the underpayment is due to the fraud of that spouse. For example, if you have a bank account that earns interest, you must give your SSN to the bank. The number must be shown on the Form INT or other statement the bank sends you. You also may be subject to "backup" withholding of income tax. You won't have to pay the penalty if you are able to show that the failure was due to reasonable cause and not willful neglect. Identity theft occurs when someone uses your personal information such as your name, SSN, or other identifying information, without your permission, to commit fraud or other crimes.

If your tax records are affected by identity theft and you receive a notice from the IRS, respond right away to the name and phone number printed on the IRS notice or letter. Victims of identity theft who are experiencing economic harm or a systemic problem, or are seeking help in resolving tax problems that have not been resolved through normal channels, may be eligible for Taxpayer Advocate Service TAS assistance. Deaf or hard-of-hearing individuals can also contact the IRS through relay services such as the Federal Relay Service available at www.

Protect yourself from suspicious emails or phishing schemes. Phishing is the creation and use of email and websites designed to mimic legitimate business emails and websites. The most common form is the act of sending an email to a user falsely claiming to be an established legitimate enterprise in an attempt to scam the user into surrendering private information that will be used for identity theft. The IRS doesn't initiate contacts with taxpayers via emails. Also, the IRS doesn't request detailed personal information through email or ask taxpayers for the PIN numbers, passwords, or similar secret access information for their credit card, bank, or other financial accounts.

If you receive an unsolicited email claiming to be from the IRS, forward the message to phishing irs. You can contact them at www. If you have been a victim of identity theft, see www. To find out whether this legislation was enacted resulting in changes that affect your tax return, go to Recent Developments at IRS. You must determine your filing status before you can determine whether you must file a tax return chapter 1 , your standard deduction chapter 20 , and your tax chapter You also use your filing status to determine whether you are eligible to claim certain deductions and credits.

You are considered unmarried for the whole year if, on the last day of your tax year, you are either: Legally separated from your spouse under a divorce or separate maintenance decree. State law governs whether you are married or legally separated under a divorce or separate maintenance decree. If you are divorced under a final decree by the last day of the year, you are considered unmarried for the whole year. If you obtain a divorce for the sole purpose of filing tax returns as unmarried individuals, and at the time of divorce you intend to and do, in fact, remarry each other in the next tax year, you and your spouse must file as married individuals in both years.

If you obtain a court decree of annulment, which holds that no valid marriage ever existed, you are considered unmarried even if you filed joint returns for earlier years. You must file Form X, Amended U. Individual Income Tax Return, claiming single or head of household status for all tax years that are affected by the annulment and not closed by the statute of limitations for filing a tax return.

Generally, for a credit or refund, you must file Form X within 3 years including extensions after the date you filed your original return or within 2 years after the date you paid the tax, whichever is later. If you filed your original return early for example, March 1 , your return is considered filed on the due date generally April However, if you had an extension to file for example, until October 15 but you filed earlier and we received it on July 1, your return is considered filed on July 1.

If you are considered unmarried, you may be able to file as a head of household or as a qualifying widow er. See Head of Household and Qualifying Widow er to see if you qualify. If you are considered married, you and your spouse can file a joint return or separate returns. You are considered married for the whole year if, on the last day of your tax year, you and your spouse meet any one of the following tests. You are living together in a common law marriage recognized in the state where you now live or in the state where the common law marriage began.

You are married and living apart, but not legally separated under a decree of divorce or separate maintenance. You are separated under an interlocutory not final decree of divorce. If your spouse died during the year, you are considered married for the whole year for filing status purposes.

If you didn't remarry before the end of the tax year, you can file a joint return for yourself and your deceased spouse. For the next 2 years, you may be entitled to the special benefits described later under Qualifying Widow er. If you remarried before the end of the tax year, you can file a joint return with your new spouse. Your deceased spouse's filing status is married filing separately for that year.

If you live apart from your spouse and meet certain tests, you may be able to file as head of household even if you aren't divorced or legally separated. If you qualify to file as head of household instead of married filing separately, your standard deduction will be higher. Fixed or Determinable Gains, Profits, or Income: Income Tax Collected at Source: Anticipatory Assignment of Income: Transit Passes Van Pools: Partnership Liability Versus Partner Liability: Holding Period of Capital Assets: Inclusion of Amounts in Gross Income of Beneficiar: Not Clearly Reflecting Income: General Rule for Inventories: General Rule for Methods of Accounting Permissible v.

Return of Capital v. Adjustments Required by Changes in Method of Accounting: Change in Method of Accounting for Depreciation: Bingo, Keno, and Slot Machine Winnings: Treatment of Funded Welfare Benefit Plans: Did Not Reduce Income Tax: Adjusted Basis for Determining Gain or Loss: Compensation for Injuries and Sickness Excluded v.

Taxability of Corporation on Distribution: Straight Debt Safe Harbor: Complete Termination of Interest: With Respect to its Stock: Installment Method Available v. Income Tax Credit in Lieu of Payment: Fuels Not Used for Taxable Purposes: Power to Alter or Amend: Additions to Irrevocable Trusts: Not Gross Income Rate and Measure of Employee Tax: Personal Interest in General: Damages, Court Awards, Settlements: Extension of Time for Making Certain Elections: Special Valuation Rules for Transfers in Trust: Disposition of Certain Life Estates: Recovery With Respect to Gift Tax: Transfers in General Gift v.

Property in Which Decedent Had an Interest: Contributions to the Capital of a Corporation: Not a General Power: Court Awards, Settlements, etc. Not a Capital Asset: Capital Expenditures Deductible v. Modifications of debt instruments: Powers of Appointment Transfer v. Powers of Appointment Included v.

Liability and Payment of Employer Tax: Payment of Personal Expenses: Amendments to Wills or Revocable Trusts: Interest on Certain Deferred Payments: Debt Instruments Subject to Section Determination of Amount of Original Issue Discount: Qualified Terminable Interest Property: Residential Energy Efficient Property: Renumeration Not Subject to Withholding: Exempted Loans In general: State and Local Tax Incentives: Withholding on Payments of Indian Casino Profits: Persons Engaged in Trade or Business: Gains or Losses From Certain Terminations: Withholding of Tax on Nonresident Aliens Required v.

Withholding of Tax on Foreign Corporations Required v. Refund of Taxes or Duties: State and Local Income Tax Refunds: Clarification Of Taxation of Certain Funds: Returns Regarding Payments of Interest: Taxation of Designated Settlement Funds: Determination Under the Facts: Income of States, Municipalities, etc. Health and Accident Insurance: Accident and Health Plans Excluded v.

Publication 17 (2017), Your Federal Income Tax

Treatment of Property Distributed in Kind: Wages Subject to Withholding: Payments in Course of Trade or Business: Transportation of Persons by Air Taxable v. Prospective Application of Rulings: Not Eligible for Dividends-Paid Deduction: Definition of Regulated Investment Company: Not a Deduction for Dividends Paid: Certain Trusts Permitted as Shareholders: Income for Benefit of Grantor: Imposition and Rate of Tax: Excise Taxes on Acts of Self-Dealing: Payment of Legal Fees: Loan or Mortgage v. Capital Contributions by Nonshareholders: Inclusion in Employee Income:

- Par la piquage de mon pouce - Con la puntura del mio pollice (French and Italian) (French Edition)

- Him (Them Series Book 1)

- Some Sweet Day

- Gastroenterology: Inflammatory Bowel Disease (IBD): Part 2 (Audio-Digest Foundation Gastroenterology Continuing Medical Education (CME). Book 24)

- November 2012 FitnessX Magazine

- The Guillotine Falls - A Mallory Masters Mystery