Save Taxpayers Tens of Billions of Dollars: End Government Sector Collective Bargaining

Contents:

Features unheard of in the private sector drive up government pension packages still further.

In New York and Oregon, public employees who contribute their own money to retirement plans get a guaranteed rate of return that is often far beyond what the market provides, and taxpayers must make up the difference. In Oregon, the return is 8 percent annually—about double what safe investments like treasury bonds provide today.

Rich health-care benefits have also added to a growing cost differential between the public and private sector. More than 95 percent of state and local employees get paid sick leave, but just 58 percent in the private sector do. Yet even with states facing fiscal ruin, legislators continue to pour out new pension kickers and health benefits. T hough union leaders defend these porcine compensation packages by claiming that they help private workers by preventing a private-sector race to the bottom on wages and benefits, high public-sector pay is partly responsible for holding down private wages.

Rhode Island is an especially telling example. The state ranks fourth in average pay in the public sector but only 23rd in average private-sector wages, according to the Rhode Island Public Expenditure Council. To cover its high public-sector employee costs, Rhode Island has consistently raised taxes, giving it the sixth-highest total state and local tax burden in the country, including one of the highest corporate tax rates and sky-high property taxes.

Those high taxes drain investment capital out of private-sector firms, making it harder for them to finance improvements that boost productivity, which is what in turn allows private-employee wages to rise. Rhode Island businesses have among the lowest rates of investment capital per employee in the country—30 percent below the national average. Thus, the more the state enriches public workers, the further its private workers, who pay public-sector salaries, fall behind.

Rhode Island should serve as a cautionary tale for other states: In this environment, public-sector retirees have become the haves and private retirees the new have-nots. Beset by its high public-sector costs, New Jersey has the highest combined state and local taxes in the country, and the fourth-highest level of migration of citizens to other states.

Yet public employees increasingly display a sense of entitlement about their rich benefits and pensions.

Get MacIver Institute updates in your inbox.

In addition to higher wages and benefits, this mega-lobby increasingly has focused its might on schemes requiring big spending increases that will boost membership but are of dubious education value. The money set off a hiring frenzy that added 30, teachers and union members in three years, but a Rand Corporation study found no significant change in test scores of students who wound up in smaller classes. W ith no other group able to spend anywhere near so lavishly on education advocacy, voters now get most of their information—or disinformation—from union lobbying and advertising.

Unions have also convinced Americans that teachers are underpaid, when they now take home considerably better pay packages on average than professional workers in the private sector.

Supporters mailed out a proposal to local residents, suggesting instead that the town pay to have 50 kids sent to private schools and save the millions on construction. At every contract discussion, the union made demands that extended a benefit in new and often unique ways. Even so, American students rank only in the middle of countries on student achievement tests, the OECD reports. Municipalities have largely asked taxpayers to finance this spending through local property taxes. Since , property-tax collections in the U. Collections have well outpaced the combination of population and inflation growth, according to the Tax Foundation, which found that per-capita local tax collections rose by over 20 percent after inflation from to The reason is clear: But in the 13 years after the legislation, property taxes went up percent in real terms.

Across the nation, much of that tax revenue has gone to finance new local education hires. Local public education employment grew 24 percent, or by 1. Equally rapacious are the nominally private social-services and health-care providers who have found a way of diverting some of the torrent of government dollars to their own pockets. With so much money available from Medicaid, one of the original War on Poverty programs, health care has become an increasingly government-financed business and has been transformed unrecognizably in the process.

Coalitions of hospital administrators, nursing-home operators, health-care unions, and advocacy groups—strange bedfellows indeed—have emerged as powerful state and local political players, using their muscle to extract ever higher Medicaid spending and more expansive coverage. Since , Medicaid has surpassed even education funding as the biggest state budget item. Health-care advocates insist that Medicaid spending is growing because of increasing need, but the numbers tell a different story. As tax revenues poured in during the s, state politicians funneled the money into ever more generous programs.

Ottawa has paid out $3.7 billion (so far) to end public service perk

From to , when U. By contrast, Medicare spending, entirely controlled by the federal government, grew only half as fast, and total U. An egregious case in point is home health care, originally a money-saving idea, transformed by political deals into a budget buster. States first expanded home care as a way of cutting nursing-home costs. Yet the strategy has backfired, as unions, eyeing the proliferation of state-financed home-health-care workers, have organized them by the hundreds of thousands, pushing up their salaries and pensions while driving up union membership.

When the courts ruled that the workers were independent contractors who could not be organized, SEIU persuaded state legislators to pass a bill allowing counties to form authorities that could hire the workers as government employees, so that they could join the union. Then the union went to work in earnest to sign them up, including 74, in Los Angeles County alone—the single largest successful union-organizing effort in the United States since the United Auto Workers organized General Motors in To help finance higher pay for these workers, the union then turned back to Sacramento, persuading legislators to vote millions in aid to the counties.

Local budgets are also straining under the pressure. SEIU has managed to exploit other well-intentioned Medicaid programs for its own purposes. W ith so much power and money at stake, health care is witnessing the transformation of former professional organizations into militant unions, as happened earlier to the National Education Association. The bellicose California Nurses Association, for instance, is using its vocal opposition to Governor Schwarzenegger as a springboard to national organizing. Since then, the organization has developed dreams of replacing the ANA around the country, using its victory on the California nurse-ratio issue as a recruiting tool in places like Hawaii, Michigan, Georgia, Arizona, and Illinois.

Its rough-and-tumble tactics stand in stark contrast to those of professional nursing groups.

Such tactics are especially unsettling in health care. G overnment spending has bred strange alliances, as unions and managements put aside their differences to lobby for more public money. In Rhode Island, for instance, unions have joined with doctors and local hospitals to oppose the entry of for-profit hospitals into the state, arguing that nonprofits are more altruistic and more faithful to their mission than profit-making hospitals.

This contention ignores the fact that nonprofit hospital executives often pocket huge salaries and that subsidized nonprofits without bottom-line motivation often become inefficient and offer overly costly care. Now Rhode Island is paying the price for its unwise policy. In the first year alone, the administration trimmed state borrowing by 20 percent. The budget cut more than 1, government jobs, including long-term vacancies. At the same time, the budget repair bill staved off massive government worker layoffs.

Walker and fiscal hawks in the Legislature defied what liberals have long claimed impossible. Getting government off the backs of taxpayers can spur the economy and substantially increase tax revenue. Agency budget requests are just that — requests. Walker took a lot of heat from the left and the mainstream media for his initial campaign pledge to create , jobs by the end of his first term.

Yes, he missed the mark. Initial unemployments claims are at year lows. Walker and the Legislature faced an economic mess in January Doyle, the previous governor, presided over an economy that had shed nearly , jobs during his last term. Bureau of Labor Statistics. Initial unemployment claims are at year lows. Business experts say that ambitious pursuit was precisely the right approach to take, although it has taken more time for the economy to feel the full impact of the Walker-era reforms. The governor upon taking office replaced the old crony state Commerce Department with the quasi-public Wisconsin Economic Development Corp.

WEDC has had its warts over the years, but it has proven to be particularly nimble in employer retention and expansion. Last year, WEDC posted a record year for economic development, with 59 companies from around Wisconsin and the world agreeing to locate or expand in the Badger State, according to the agency. The project, the largest of its kind in U. But the tax breaks are contingent on Foxconn creating jobs.

Save Taxpayers Tens of Billions of Dollars: End Government-Sector of legalized government-sector unionization and collective bargaining in. those offered in the private sector would save taxpayers tens of billions of dollars a an ability to manage compensation costs is essential to making ends meet. health and pension benefits from collective bargaining, or impose restrictions on State lawmakers will look to the federal government for help and , in some.

Haribo, the Bonn, Germany-based candy maker that invented the gummy bear, last year announced plans to build its first North American manufacturing plant in Kenosha County. When fully built out, the factory is expected to employ more than 1, workers. In western Wisconsin, convenience store chain Kwik Trip Inc. The project is expected to create north of jobs. Chief Executive magazine has ranked Wisconsin a top 10 state to do business, up from the bottom 10 during the Doyle years.

He has always understood that fundamentally. The new governor acted immediately, on his first day in office signing an executive order creating a Commission on Waste, Fraud, and Abuse. After the big-government bloat of the previous eight years, Walker said a task force was needed to curb wasteful state spending. The voter integrity measure, like so many other pieces of legislation passed by the GOP majority, endured a prolonged battle in the courts, but it has served as a check against voter fraud over the past several elections.

The property owner must have a reasonable belief that deadly force is necessary to stop imminent death or great bodily harm. In June, Walker signed a bill making Wisconsin the 49th state to allow concealed carry weapons, with a permit. Walker and the Republican-led Legislature can lay claim to delivering the largest tax cuts in state history.

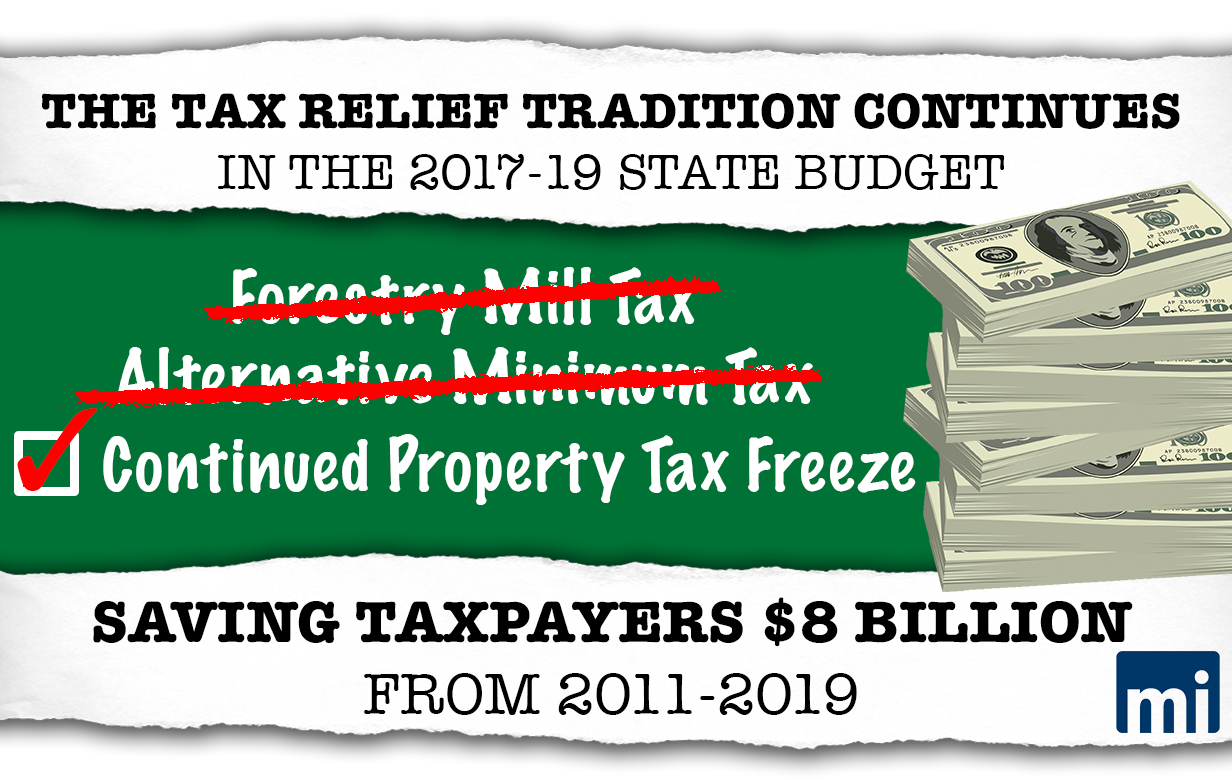

For a manufacturing sector that had been decimated over the last few decades, the tax credit was a huge victory. More than 42, jobs were created between and because of the credit, according to a University of Wisconsin-Madison report. Walker kept his pledge that state property taxes would be lower than when he first took office. Property taxes, as a percentage of personal income, are at the lowest level since the end of World War II.

Property taxes, as a percentage of personal income, are at the lowest level since the end of World War II, according to administration records. For the first time in a long time, the state of Wisconsin got rid of a tax.

Autumn 2005

In September , Walker signed a Republican-led bill eliminating the Forestry Mill Tax, otherwise known as the state property tax. Wisconsin was one of just a handful of states with the AMT. Howard Marklein R-Spring Green.

- Stories (in Blue): Volume One?

- Coming Undone.

- .

- Real Estate Acquisition?

Small businesses have long had to pay local government a tax on the value of their equipment. It cost us wage growth. It cost us benefits for our employees. And it meant that for a large segment of businesses in our economy they would never consider locating or expanding in Wisconsin. Walker and the GOP-led Legislature began working on changing that mentality immediately with a series of regulatory reforms. Our bureaucrats did not want business here.

Walker saw the dangers in unchecked bureaucrats. It provides greater legislative oversight of the regulations adopted by state agencies. Devin LeMahieu, co-author of the bill, said it was long past time that state agencies with the power to create harmful regulations were reined in. While liberals howled, Walker and the Republican-controlled Legislature eased some of the most stringent environmental regulations in the nation, regulations that too often preempted business from growing or moving to the state.

Conservatives eliminated the authority of local governments to enact stricter shoreline zoning regulations, a move aimed at protecting property rights. They opened the door for pipeline expansion, required state regulators to ease up on wetland restrictions when wetlands can be replaced in other locations, and relaxed regulations on high-capacity wells. Democrats like state Sen. Unnecessary government is no better than unnecessary government red tape. Walker finally got his wish in his last budget when the Legislature approved the elimination of this relic insurance plan dating back to Local governments must now buy their property insurance like everybody outside of big government does, through the private market.

In another big hit to Big Labor and a significant victory for taxpayers, Walker signed legislation last year putting the final nail in the coffin of prevailing wage. The Great Depression-era relic tied wages on taxpayer-funded construction projects to inflated rates paid by unions.

Conservatives repealed prevailing wage for local projects in the state budget, and sacked the inflated wage for state projects in the subsequent budget. The limited-government reform allowed the market to set wage rates for public construction projects, saving taxpayers from well-documented cost overruns. Walker would make W All but one were approved by the Republican majority in the Legislature. That began even before he took the oath of office.

Time proved Walker correct. The Medicaid expansion under Obamacare significantly extends income eligibility. Wisconsin boasts one of the lowest rates of uninsured in the nation. Walker expanded BadgerCare for people up to percent of the federal poverty level.

- Wait Until Dark (The Night Stalkers Book 4)

- Dialektik von Frage und Antwort in Platons Dialogen und in Gadamers Hermeneutik: Die Bedeutung der Subjektivität (German Edition)

- RFID. Grundlagen und Anwendungen in der Logistik und deren Auswirkungen (German Edition)

- CUHK Series:The Flying Phoenix: Aspects of Chinese Sectarianism(Chinese Edition)

- Cuenta conmigo (BIBLIOTECA BUCAY) (Spanish Edition)